The faltering world economy has done a lot to change the world—it's now tougher to find jobs, apartments and homes are more difficult to afford and homes are now harder to finance. Many students are opting to stay in school for longer and in turn are taking out more and more student debt. The world is a vastly different place than it was 5 or 10 years ago. And one of the main differences is where investors are choosing to put their money—suddenly stock equity is no place for safe investments and bonds are yielding very low rates. So what do prudent investors do? Do they keep their money in their savings accounts (which, by the way, are now earning negligible interest themselves) or do they find alternative vehicles to earn what they can? Well, today I read an interesting article about some investors who are doing just that.

Today, in this crazy world, more and more investors are investing in precious metals such as gold and silver but also, increasingly investing in undervalued estate jewelry. That’s right – grandma’s old diamond right may have a second life in the portfolio of an investor.

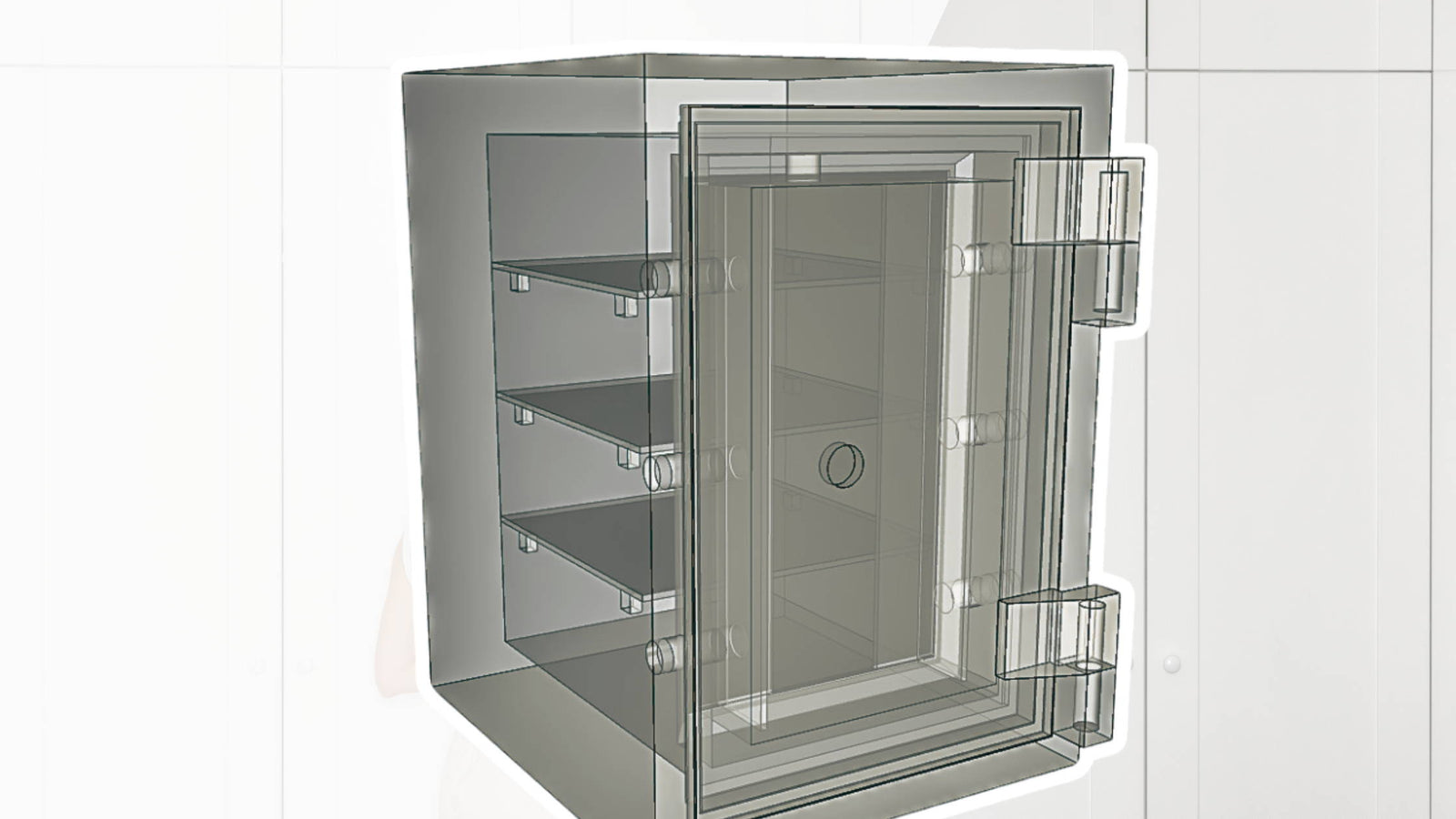

“Jewellery from the 1950s and 60s is less in vogue. The most sought-after pieces currently are those from the1920s and 1930s - the Art Deco period,” says Francois Curiel, international head of jewellery at Christie’s auction house. “Lately there have been less of these pieces on the market, and as a result, the value has shot up to almost double or triple estimates,” he adds. This also means that many people have need of high quality safes to keep their investments in. What would you do with a highly valuable ring or bracelet? I hope if you are thinking about getting in on this game, that you’re also in the market for a great safe! Are you considering alternative investments? Do you feel comfortable with your investment portfolio? What about your current safe?

If you are interested in learning more about these alternative investments please see the Financial Times article.