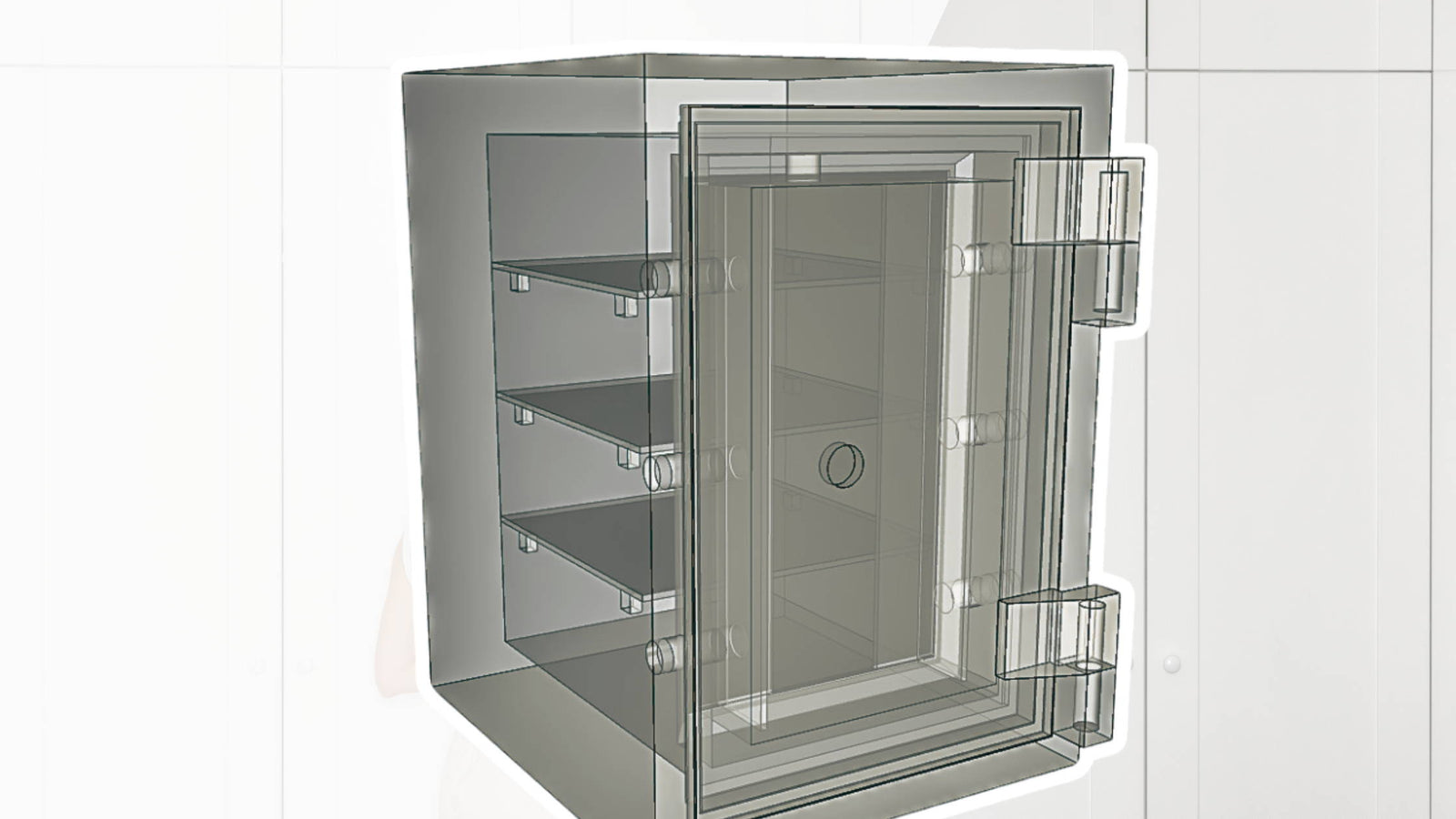

A safe deposit box (sometimes incorrectly called a safety deposit box) is a type of safe usually located in groups inside a bank vault or in the back of a bank or post office. They are also used in hospitality applications such as hotels/motels and grocery stores. In the typical arrangement, a renter pays the bank a fee for the use of the box, which can be opened only with production of the assigned key, the bank's guard key, the proper signature, or perhaps a code of some sort.

Safe deposit boxes are made to be highly "resistant" to fire, flood, heat, earthquakes, hurricanes, explosions or other disastrous conditions provided they are in a bank vault. There is no 100% guarantee against damage, however, and substantial losses can sometimes occur.

What items should not be kept in a safe deposit box? DO NOT put your original wills, trust instruments, or powers of attorney in a safe deposit box. Why? When someone dies, the safe deposit box may be sealed depending on the states law for weeks at a time which will result in delays trying to open it. Money might even have to be spent to acquire a court order in order to open the box. Also the wills executor may not be able to get access to the safe deposit box without a will that shows they are indeed the executor. Any original documents should be kept at home in a safe.

Safe Deposit Box Storage Safety Tips

- Always keep your eye on the bank teller. When getting your box, insist on keeping it always in plain view, both when receiving the box and returning it to the vault. Do not simply hand it off to the bank employee to put away.

- Always keep written records and pictures of what you keep in your safe deposit box since the banks do not keep any records.

- Prevent water damage by sealing items in airtight, zip-lock bags or Tupperware-style containers.

- Put your name on each item to help successfully identify it in case a disaster occurs or it goes missing and is found. The FDIC does not insure damages or loss to anything you store in your safe deposit box since it is just a storage space provided by the bank. Check with your insurance company to see if your homeowner's or tenant's insurance policy will cover your safe deposit box contents against damage or theft. Many do cover contents up to a certain dollar amount, even included items lost or damaged when they are out of the box. If your home-related insurance is not sufficient, talk to your insurance agent about additional protection or find out if your bank is among those selling limited insurance coverage on safe deposit boxes. Before buying any extra coverage, review the policy and do some comparison shopping.

- When storing items in a safe deposit box, make sure that any original paperwork that may be needed in case of death or in case of an emergency is kept at home in a fireproof safe, and the copies can be stored in the box.

- Keep written records and pictures of any items stored in case of loss or damages.

- Make sure you can get proper insurance coverage on your items. A safe deposit box is generally safer than keeping your items at home in a safe or file cabinet, but it is not 100% guaranteed and losses or damages can occur.